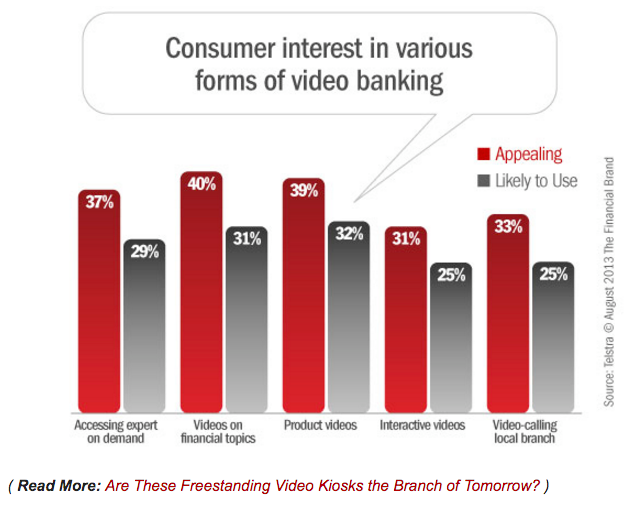

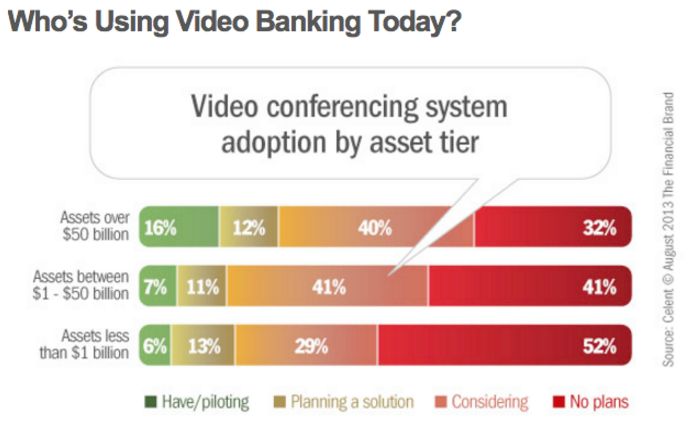

The financial and healthcare industries have been early adopters of video conferencing and use it not only to organize meetings internally but to deliver services to their end users. If you’ve already downloaded a banking app on your phone or deposited a check online, you know how easy online banking can be. Video banking allows bank service to become more robust and soon customers will be able to do all kinds of more complex transactions online or through interactive teller machines. Customers are excited about video banking and financial institutions are already rolling out these programs. Take a look at the following charts:

Banks all over the world have already started rolling out these interactive teller machines and even more have plans to add them soon in addition to working on more robust phone applications. Let’s take a look at some of the ways new technology provides huge advantages to both the financial industry and its customers.

Future Outlook for Video Banking

Overall, we’re finding that video banking has a positive outlook due to some very obvious advantages.

- According to Abha Bhattarai at Washington Post, “Video tellers typically cost between $50,000 and $60,000, about the same as an ATM.” This means the price of technology is not much higher for the enhancements they offer. The article went on to explain that, similar to ATMs, video banking machines can easily perform basic transactions such as deposits and withdrawals. These video-enabled machines also come equipped with video and audio capabilities, as well as check scanners and signature pads to accommodate more nuanced requests.

- Video tellers allow banks to reduce travel expenses and cost of staffing local offices. Banks will still have branch offices, but they will be able to reduce in-office staff and regional visits as they manage their teller support from a central location.

- Bank kiosks can offer a wider range of services to customers in some cases where it is hard to find the technical expertise for every branch office. This provides upsell opportunities and allows the financial institution to become a one-stop shop for their customers

- Video banking is paperless which means working with online forms allows banks to cut down their carbon footprint.

- Video banking services eliminate human error when it comes to updating the database or reconciling the books.

Benefits for Customers

- Customers in rural locations or emerging markets can gain easy access to a majority of needed banking services without having to travel a long distance to a branch office.

- Video banking allows for extended, or even 24/7 access to banking services and human tellers, customers won’t need to take off work early or stand in long lines at lunch. People can bank on their own schedules. Extended hours may even include those infamous banking holidays.

- The technology behind video banking opens the door for added security benefits such as facial or voice recognition tools that can help avoid fraud and begin service faster. According to American Banker, “Other video providers, such as Xura, which launched last year, say that video chatting could also make the authentication process easier. For instance, biometric technology could verify a customer in the background of the video, allowing the banker to more quickly address the customer’s needs.”

- Bank customers can gain access to financial subject matter experts and training easily. Having video banking online means that you can quickly reach human tellers with deep knowledge of niche topics as those experts can help customers anywhere. The next time you need a mortgage specialist, you can simply hop on a video call to reach someone immediately.

- Lines are shorter (or non-extent) online. Online video banking services, specialists are able to spread out their help for everyone at once so you’ll never wait in line for your whole lunch break at one branch only to hear your coworker was in and out at another branch across town.

Overall, it’s just easier to do you banking when technology is involved – period. According to Cisco, “78 percent of consumers in developed countries and 72 percent of consumers in emerging markets prefer to use a bank’s web applications for transactional purposes such as paying bills, managing accounts, and checking balances.” Whether you’re depositing your check via a mobile device or using video teller machines to conduct your business, it’s just more convient. Plain and simple.

Next Step: Interactive Teller Machines

It’s widely known that video teller machines cost about as much as current ATM machines and allow customers to do more transactions while working with an interactive teller face to face. According to the Washington Post “The machine does 95 percent of what a teller can do inside the branch” so the branch office will be there for anyone that needs it while simply adding more options for customers. It’s the idea of interactive teller machines that will truly take cleaning to the next step.

Many companies are looking into expanding their video services online or to mobile financial applications to make banking even easier. Many users are already logging into their mobile banking app with a quick fingerprint scan to quickly deposit checks, transfer money, or take a look at their spending. Soon, you will also be able to reach a teller to talk you through more complex transactions or attend training seminars from the comfort of your own home. Say goodbye to the pneumatic tube and hello to your new video banking concierge!

Thanks for reading! If you have thoughts or comments, we’d love to hear them via the comments section below.